HubSpot’s Data Reveals How COVID-19 Has Affected Businesses

HubSpot has released a COVID-19 web page that documents how the pandemic has affected businesses, based on aggregate data collected from its global customer base of 70,000+ companies. The data exposes certain trends and establishes benchmarks against which you can measure your own business. Here are some of the implications of the data.

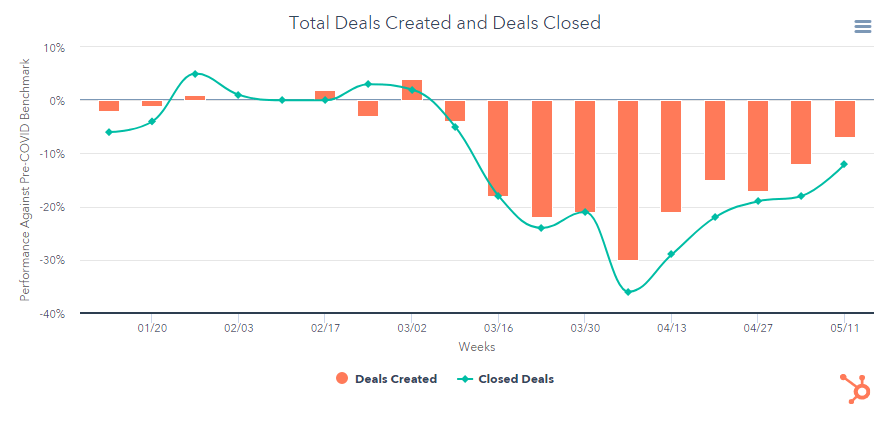

Deals Created and Closed

The first thing you’ll notice is that the deals created and closed drop significantly during COVID-19, most likely because prospects have cut back on their non-essential spending until things calm down. While this result may seem obvious, it’s essential to base your decisions on real data because some companies have actually seen a positive or neutral change in sales due to COVID-19.

Closed deals have gotten closer to their pre-COVID-19 benchmark each week since the initial drop to 36% below the benchmark. Based on this trend, closed deals may slowly return to the benchmark or plateau at 20% for a while.

The regions that have seen the biggest drops are Latin America, Europe, the Middle East, and Africa. The consumer goods and construction industries have seen a slight uptick over the past week; all other industries are down significantly compared to their benchmarks.

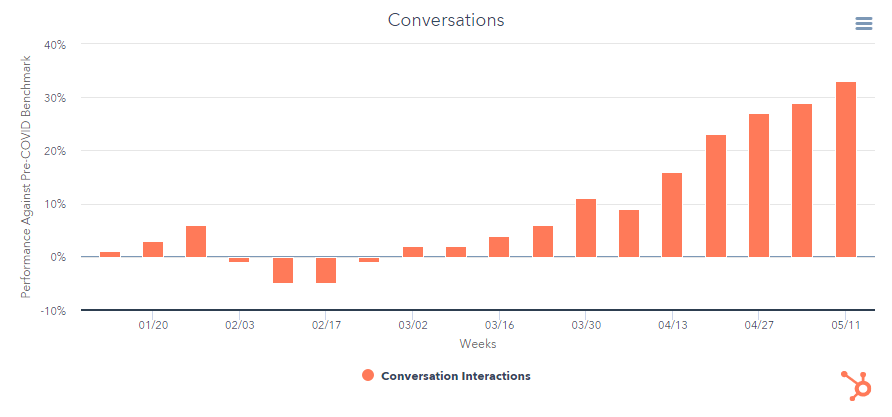

Conversations

If you hop over to the Conversations tab, you’ll notice that there has been an almost linear growth in conversation interactions through HubSpot week over week. And that makes sense: Forced to work from home, employees have had more time and opportunities to interact online with businesses.

Perhaps people are going stir-crazy and considering what they’ll buy once things return to normal. Or perhaps they have more time to voice their concerns or ask questions. Companies are probably contributing to this growth by offering more digital support than before.

Moreover, if you filter the data by region, company size, and industry, you’ll discover some interesting insights. Every region in the world has seen an increase in conversations, with Asia-Pacific leading the pack. And every company size, big or small, has increased its conversations. It’s a global trend.

Nearly every industry has seen a jump in conversions except for the travel industry, which has seen severe drops. Will the travel industry bounce back eventually, or will this pandemic keep its business low for years to come?

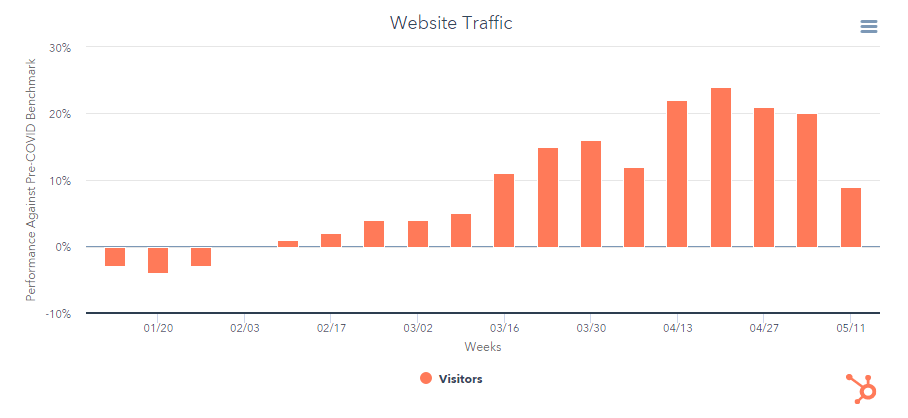

Website Traffic

The Website Traffic tab confirms what many of us are thinking: COVID-19 has pushed people to spend more time online, which has increased site traffic for a lot of businesses. However, as with conversations, the only exception is the travel industry, which has seen significant drops of up to 40% below the benchmark.

Some people in the travel industry project that the industry will still remain below benchmarks a year or two from now since people may fear traveling. Will this result in cheaper flight deals, the collapse of companies, or something else entirely? We’ll have to wait and see. Many travel blogs rely on credit card sign-up affiliate partnerships to make their money. Unfortunately, many travel credit cards paused their bonuses during the COVID-19 crisis.

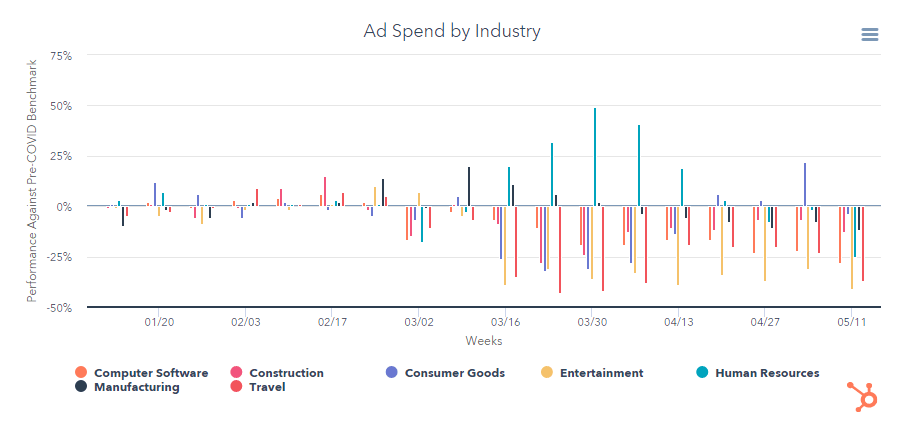

Ad Spend

There has been some debate about whether now is a good time to spend on digital advertising. Some people are pulling out, others are increasing their spending, and the rest are unsure about whether people will buy despite the drop in CPMs. With HubSpot’s data, we can now clearly see a significant dip below pre-COVID benchmarks for ad spend. The data doesn’t change much when you filter by company size.

If you filter by industry, though, you’ll see that human resources is the only one that increased its spend at the start of COVID shutdowns. But by the middle of April, they reduced their spending back to the benchmark. That could imply that they were the slowest to react to COVID or that they increased their spending only to realize that they weren’t getting the results they wanted, so they pulled back.

Our virtual CMO roundtable discussions have featured human resource participants in the past. Based on the conversations we’ve had, we know that many companies have paused hiring decisions and spending. There’s likely a surge of people looking for work since unemployment rates are higher than ever before. But many factors may cause this industry to pause its efforts, such as budget cuts, uncertainty from management, and the desire to screen someone in person as opposed to virtually.

You’ll also notice that ad spending for consumer goods shot up to almost 25% above the benchmark. With such a large diversity of products to offer and so many people cooped up at home, this industry may very well find that digital advertising pays off.

We will likely see advertisers return to the marketplace sooner rather than later because more people are online than ever before, and marketers are capitalizing on that attention. As quarantine restrictions are gradually lifted, advertisers will seek out those cheaper-than-usual costs, which will in turn lead to more fear of missing out as everyone returns.

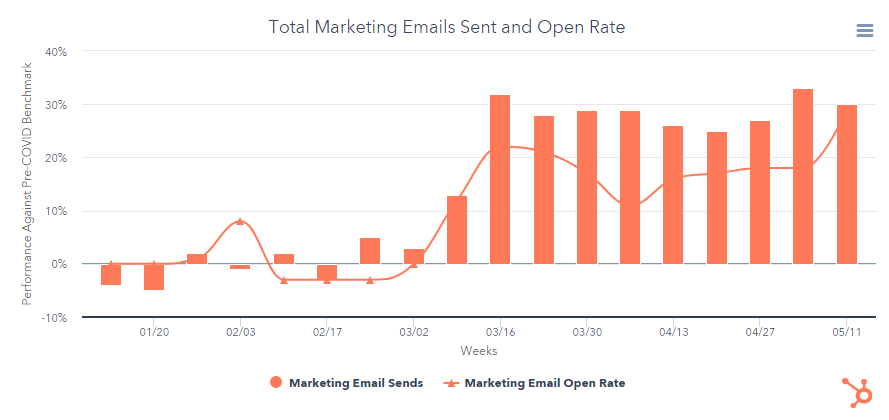

Marketing Emails Sent

The Marketing Emails data mirrors the patterns we’ve seen with website traffic. Most likely, businesses realized that more people are online and began sending a larger volume of marketing emails. In fact, as early as March 16th, marketing emails jumped 32% above the benchmark and have stayed there ever since. Of course, the travel industry realized that it was fruitless to send marketing emails, so its number of emails sent dropped by 33% during the same period.

What this means for you is that your typical recipient’s email inbox is now saturated and highly competitive, making it difficult to break through the noise and grab someone’s attention.

It’s good that the current circumstances have pushed marketers to do something that they should’ve really been doing in the first place. But from a competition perspective, it may be good to look for other avenues to get in front of prospects. Email marketing is still important and creates sales, which is why we still send out emails. You should still send emails, too—at least once a month. But don’t make it your number-one priority right now.

WebMechanix’s own email data shows that open and click-through rates haven’t been affected much, but results could be different for your business.

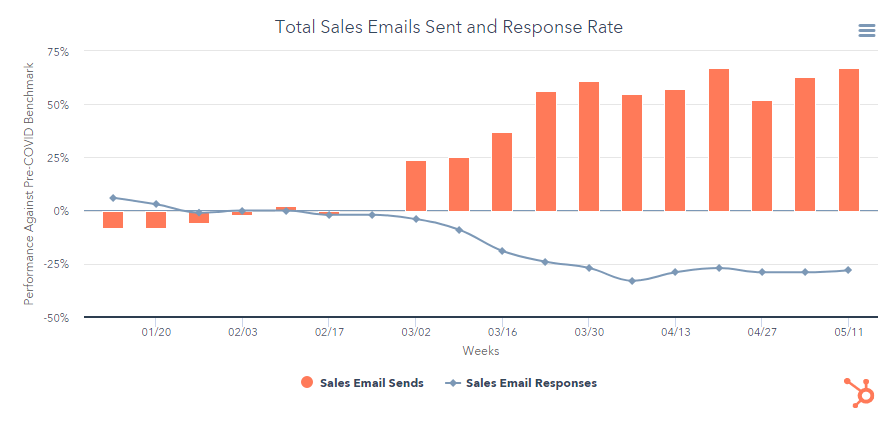

Sales Emails Sent

The sales email data offers the most interesting patterns. We see that the number of sales emails sent has gone up dramatically and has lingered around 50 to 60% over the benchmark since COVID-19. Most of this is accounted for by businesses with 26–200 employees. Unfortunately, the data seems to suggest that this effort hasn’t been paying off: The number of sales email responses has dropped noticeably to 25% below the benchmark.

From conversations we’ve had during our CMO roundtables, it’s clear that most prospects are reluctant to make big purchases right now.

With so many people sending emails and prospects holding off on non-essential purchases, sales may find it more worthwhile to pursue other activities. For example, instead of sending more HubSpot sales sequences, your sales team may benefit from more marketing-sales alignment since most prospects are currently in a “nurturing” stage. This may involve learning more about your prospects and building long-term relationships in preparation for life after COVID-19.

Conclusion

Based on the data, the best thing to do now is to realize that we’re currently in a nurturing rather than buying stage thanks to COVID-19. While there are more people online, marketers have saturated email inboxes, and ad costs are lower than usual.

Bottom line? Focus on nurturing activities outside of email marketing. Keep tabs on digital advertising because more advertisers may begin returning, and this may be a great time to get a good bargain on ads as quarantine restrictions are lifted.

What are your thoughts on this data? Are there any trends that you or your colleagues have witnessed?

Most newsletters suck...

So while we technically have to call this a daily newsletter so people know what it is, it's anything but.

You won't find any 'industry standards' or 'guru best practices' here - only the real stuff that actually moves the needle.