The Breakdown: Google Ads Will Charge Fees for Advertising in the UK, Austria, and Turkey

Starting November 1st, 2020, Google Ads will charge an extra fee for ads served in specific countries. Google will use these fees to cover the taxes that Austria and the UK are levying on digital services like Google Ads, as well as to compensate for the increased complexity of advertising regulations in Turkey.

“Wait, I don’t advertise there, why should I care?”

Glad you asked. We believe digital advertising costs will continue to increase. Between taxes and (potential) regulation, “big tech” has a target on its back from both legal and economic angles.

It seems governments across the world see “big tech” as a lucrative source of new revenue. These countries are the first to impose taxes, but it’s possible more are right behind them.

Meanwhile, at home, the United States is probing “big tech” for anti-competitive behavior and thus threatening antitrust lawsuits.

And we haven’t even mentioned 3rd party cookies being phased out, which while that’s a good thing for user privacy in general, it also helps Google further strengthen their grip on the digital advertising space. More grip means more pricing power which in general means … you got it, higher prices.

As it pertains to Google and Facebook, we believe (and are experiencing across our portfolio of client advertising accounts) that raw advertising/media costs will continue to increase.

So what can I do about it? How do I fight back?

For the sake of this post, we’ll leave you with two ideas:

- Consider increasing the conversion rates of all steps in your funnel.

- Make sure your advertising spend is well-targeted and you’ve cut all the waste.

For now, let’s focus on what’s already changed and leave the future to unfold itself…

What This Means for Google Ads Campaigns in the UK, Austria, and Turkey

Advertisers will now have to pay the following digital services taxes for Google ads run in these countries:

- 2% in the UK.

- 5% in Austria.

- 5% in Turkey.

Google adds these fees to the Google invoice on top of in-platform spend. They won’t report this under the Cost column on the platform. If you’re not advertising in these countries, you won’t have to pay for these fees.

Where Google Reports Fees

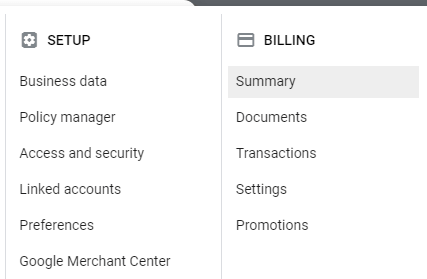

You can view these fees in either of the following places in your Google Ads account:

- In your monthly invoice or statement as a separate line item per country.

- To view a digital service tax or operating costs charge, click the tools icon and under “Billing,” choose Summary, and then click Transactions from the left menu.

How Google Ads Calculates Fees

So now you know how Google reports fees. But how do they decide what to charge? Google charges based on the number of ad impressions or clicks that are served in a specific country. If you advertise in several countries, Google will only charge you when ads have been served to people in the countries where Google is levying a tax. For example, if you advertise in Germany, Austria, and Poland, you’ll only be charged for the countries where the fees apply (in this case, Austria). Learn more about Google’s country-specific fees for advertising.

What About Facebook Ads?

It’s not clear whether Facebook has plans to pass these taxes on to advertisers. As of January 1st, it began adding a 6% service tax on ads sold in Malaysia to advertisers’ invoices.

We’ll be keeping an eye on the horizon to see how things play out.

Most newsletters suck...

So while we technically have to call this a daily newsletter so people know what it is, it's anything but.

You won't find any 'industry standards' or 'guru best practices' here - only the real stuff that actually moves the needle.